Stock Pickers Academy (SPA) is a thriving investing community that brings together beginners and experienced investors to create wealth through shared knowledge and investment ideas. Founded by Debodun, a former investment banker at Goldman Sachs, SPA is a non-advisory investment community, with over 5000 members, that encourages members to leverage each other’s expertise to make informed investment decisions.

Debodun manages SPA by applying safe entry and reasonable exit price points in a transparent and non-advisory manner. Through this approach, he has successfully guided SPA members to profitable investments in the stock market. SPA members have access to a wealth of investing resources: investment education through online courses, investment mentorship, alerts, and portfolio reviews

One of the key benefits of joining SPA is the opportunity to learn from experienced investors and gain insights into proven investment strategies. The online courses offered by SPA provide in-depth knowledge on specific investment topics, such as building a stock portfolio. The mentoring program offers ongoing support and guidance to help members make informed investment decisions.

SPA also offers an alerts service that keeps members informed about market trends and investment opportunities in real-time. Members can receive personalised feedback and guidance through portfolio reviews, helping them identify areas for improvement and maximise their returns.

Overall, SPA is an excellent resource for anyone interested in learning about investing in the stock market, property, angel investing and crypto. With a variety of services designed to support beginners and experienced investors alike, SPA offers a unique opportunity to build wealth through shared knowledge and investment ideas. If you’re looking to take your investing to the next level, we encourage you to join SPA today!

Connect with SPA services HERE

Join the SPA Telegram group HERE

Learn how to build a stock portfolio for HERE – The first session is free!

Sign up for SPA Stock Picking alerts HERE

Checkout my conversation with Debodun below, where i find out about his journey.

Read similar stories:

- The Expat taking her passion for travel to the next level

- Meet UK’s only Maize Farmer

- From Bookshop worker to owning a successful business

- UK’s Patty King

What were you doing before you started the business?

Up until 2018 SPA has been running concurrently whilst I was working as a way to give back knowledge. It only became a business during lock down. In addition to this, I run UrbanFounders to connect startups with Investors, and City Jobs Coaching where I work with Diversity recruitment agencies and universities to coach ethnic minorities both graduate and experienced hires into roles around the city and Investment Banking.

Click here to subscribe to the weekly newsletter and here to donate / leave a tip for Black Business Blog.

How and when did you get into trading?

I first started trading at university but it was virtually and mainly Forex trading. I was doing very well and winning so many competitions. However, it wasn’t real money and after securing highly competitive summer internships on trading floors of Santander and Barclays Investment Bank I eventually landed a full time job at Goldman Sachs.

Which character from ‘Industry’ reminds you of yourself when you used to work in the city?

I would say Harper but only her character inside the office not the socials – The serious side.

For those that don’t know, ‘Industry’ is a drama that documents the lives of university graduates battling the pressures of a cut throat career in Finance.

After 10 years of working as a trader, why did you give it up?

My last role was at a Quantitative Hedge Fund in the Channel Islands – I was there for 3 years and eventually got bored of the Island and decided to relocate back to London. It was a bit of a gamble but I thought I’d be ok and land something here.

Click here to subscribe to the weekly newsletter and here to donate to this blog.

What were some of the challenges that you faced when you first started Stock Pickers Academy?

The stock market is always moving so time management and prioritising questions for existing clients on their positions, managing money and teaching new clients is always a challenge. It is impossible to turn my eye away from the markets for long periods of time. Lock down has helped me to focus but some aspects of what I do are not scalable. First movers have a big advantage as my model switches from 1-2-1 service to groups and online

How do you decide which stocks you buy?

This sounds like a simple question but a lot of thought goes into my answer – I have combined my own ideas with those from the diverse community I have created. I like to keep my methods simple and that is what makes it easier to pass on. I find an industry I believe in and prioritise stocks in that. Then I diversify by lots of different factors, volatility, beta, market value and so much more which I teach on my course. Then I have a strategy on how I execute on my transactions. My portfolio returned 129% last year and I have published that on Instagram. This is despite holding 35% as cash.

Click here to subscribe to the weekly newsletter and here to donate to this blog.

What’s the most you’ve ever lost on a position and what went wrong?

Realised loss of £4000 – company went into administration. Canadian Lithium mining company which was meant to be a play in Electric Vehicle batteries raw materials. They still exist under a different trading name so I feel share holders were cheated but hey. That was 15% of my portfolio but still managed to return 129% in the same year so no complaints.

What are your thoughts on the future of banking?

We are moving more into a Big Data/AI/Robots world as part of this technological revolution. More investment is going into tech and automation. Less risk is being taken and Regulatory reform is the order of the day. Block chain is also here to stay and getting more institutional attention. On the recruitment front diversity is getting more attention and hopefully that lasts.

Read similar stories:

- The Expat taking her passion for travel to the next level

- Meet UK’s only Maize Farmer

- From Bookshop worker to owning a successful business

- UK’s Patty King

What advice would you give to a recent graduate who wants to become a trader?

Start putting in the work and study from 1st year of university. It is so competitive that you need to be on top of the knowledge and getting experience from an early stage. Work hard at university too as a good degree is important for the entry criteria. From a technical perspective commercial awareness is very key. Download finimize and follow @StockPickersAcademy on Instagram to get 34% off the annual subscription. Invest in yourself as having good commercial awareness and genuine interest is so important. Learn about the products. There is a good book called All you need to know about the City, which I found very useful when I was starting out.

What are your plans for Stock Pickers Academy this year?

I just want to see people winning financially. The plans themselves are still a bit go with the flow – I didn’t expect the demand I’m currently facing so finding solutions on the fly has been interesting and fun. I would like to create SPA kids/teens at some point as well as put a bit more work on the podcast and the other non-investing fronts. I want to get some of the black celebs involved and really diversify my client base. Long story short I want to scale and carry others along the journey with me.:

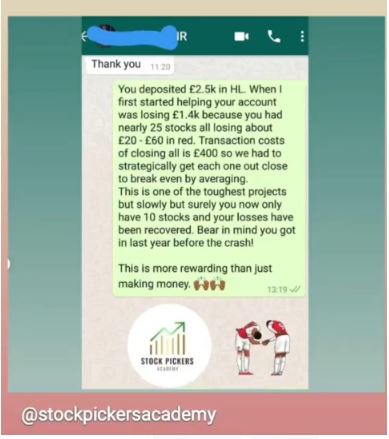

Connect with SPA on IG HERE or you can join the conversation on Twitter HERE. I leave you with some more testimonials from people who have benefited from being part of the SPA community

Lovely. Debs has always been a great teacher with winning strategies in the market.

LikeLike

[…] Learn how to invest in stock with Stock Pickers Academy […]

LikeLike

[…] Learn how to invest in stock with Stock Pickers Academy […]

LikeLike

[…] Learn how to invest in stock with Stock Pickers Academy […]

LikeLike

[…] Learn how to invest in stock with Stock Pickers Academy […]

LikeLike

[…] Learn how to invest in stock with Stock Pickers Academy […]

LikeLike

[…] Learn how to invest in stock with Stock Pickers Academy […]

LikeLike

[…] Become a Better Stock Trader: Join the Stock Pickers Academy Community Today! […]

LikeLike